Taxes

Mobile area businesses benefit from comparatively low local and state tax rates. Certain taxes impacting business can be eliminated or reduced by local and state incentive programs. AIDT, one of the nation’s top workforce training programs, offers customized, company-specific recruiting and training services to new and expanding industries in Alabama at no cost to qualifying companies.

All real property in Alabama is subject to state, county, and local property (ad valorem) taxes unless exempted by law. Additionally, this holds for all manufacturing and non-manufacturing equipment including office furniture and fixtures, computer equipment, and other items of personal property if located in the state on October 1 of the year tax abatements are approved.

All pollution control equipment acquired or constructed primarily for the control, reduction or elimination of air or water pollution is exempt from ad valorem taxes when specifically claimed. Alabama does not impose an inventory tax on finished goods, work-in-process accounts, or raw materials stocks.

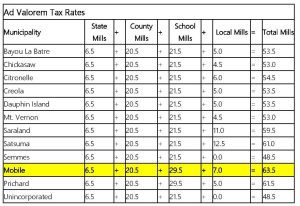

Real and personal property used for business, commercial, industrial or manufacturing purposes in Alabama is defined as Class 2 property and assessed at 20 percent fair market value. The property (ad valorem) tax rate per $1,000 of assessed valuation is as follows:

All real and personal property subject to property tax in Alabama is valued at fair and reasonable market value. Real property improvements are typically based on new replacement costs, then depreciated based on the condition of the property, and additionally taken into consideration when it is no longer being used. Land is usually valued using the market or sales comparison approach reflecting sales prices for similar properties. A value per square foot or front foot is also assigned. Personal property is valued by using the new replacement cost, then depreciated based on condition and usage.

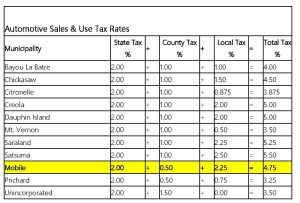

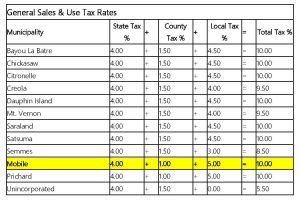

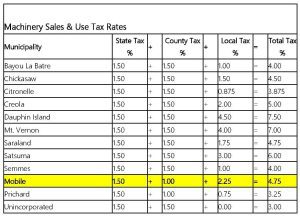

Alabama has three types of Sales & Use Tax: general, machinery, and automotive. The applicable rates for the various municipalities in Mobile County are as follows:

The City of Mobile enacted legislation exempting local sales tax on the sale or sales of specified ships, railroad cars, aircraft and materials, equipment and machinery that become component parts of those items; as well as materials and supplies used in the repair and modification of those items. The use tax rates are the same as sales tax and gross receipts.